Vancouver, BC – November 3rd, 2022, Vancouver, B.C.: Elevation Gold Mining Corporation (TSX.V: ELVT; OTCQX: EVGDF) (the “Company” or “Elevation Gold”) is pleased to announce financial results for the three and nine months ended September 30, 2022. All figures are expressed in US dollars unless otherwise noted.

Summary for the Three Months Ended September 30, 2022

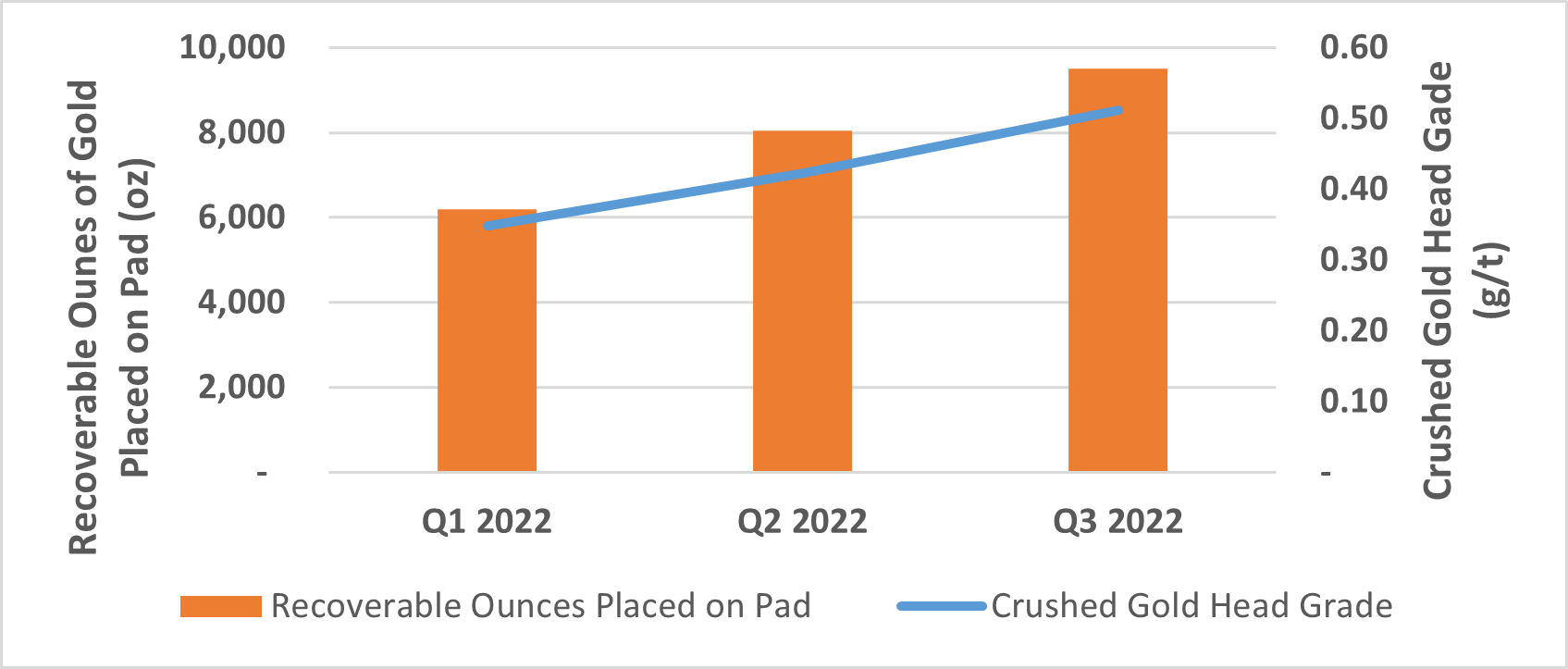

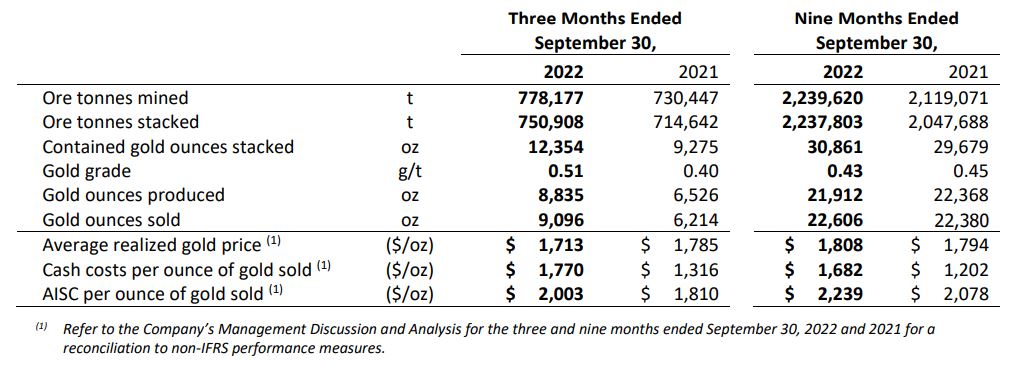

- Elevation produced 8,835 ounces of gold and 49,007 ounces of silver during Q3 2022 from 750,908 ore tonnes processed with average grades of 0.51 g/t gold and 4.08 g/t silver.

- The Company generated total revenue of $17.0 million on 9,096 ounces of gold and 75,862 ounces of silver sold. The average realized price of gold per ounce sold (1) was $1,713. Gold ounces sold represented an increase of 46% from Q3 2021 and 30% from Q2 2022.

- Q3 2022 income from mine operations before depreciation and depletion of $2.1 million and net income of $1.2 million, or $0.01 per share.

- Total Cash Costs per ounce of gold sold (1) of $1,770 and all-in sustaining costs (“AISC”) per ounce of gold sold(1)of $2,033. The Company expects to improve on its operational results in Q4 2022 with the addition of higher-grade ore sourced from East Pit, and the reduction of capital expenditure requirements as the majority of the Company’s major capital projects were completed in Q2 2022 and early Q3 2022.

- Completed a multi-phase infill and resource expansion drilling program at the Moss Mine, which included 17,197 meters of reverse circulation (“RC”) drilling in the first half of 2022. In July 2022, the Company began its maiden exploration program at Florence Hill. New RC drilling program expected to commence at Moss Mine in November 2022 to further test mineralization near Center and West Pit.

(1) Refer to the Company’s Management Discussion and Analysis for the three and nine months ended September 30, 2022 and 2021 for a reconciliation to non-IFRS performance measures.

Tim Swendseid, Elevation Gold President, stated “Our Q3 2022 financial results reflect a significant improvement in operations at the Moss Mine, with total revenue increasing 40% over Q3 2021 and 18% over Q2 2022 and gold ounces sold increasing 46% from Q3 2021 and 30% from Q2 2022. Without considering inventory swings and adjustments, cash costs per ounce approximated $1,479. We remain on track to meet sales guidance for 2022 of total ounces sold between 32,000 and 34,000 for the year. My thanks to the outstanding performance of everyone at the Moss Mine, and we continue to be excited about our current and ongoing exploration programs both in the Florence Hill area and our near-mine programs.”

The following chart provides additional information on the Company’s increasing grade and recoverable ounces placed on the pad during 2022 on a quarter-by-quarter basis.

Outlook

During Q3 2022, the Company completed several key capital projects including the completion of the construction of the new heap leach pad 2C and constructed two new production water wells. The Company also completed five new monitoring wells in Q2 2022. The monitoring wells were a requirement of our Aquifer Protection Permit, while the production water wells secure water for operations at the Moss Mine.

The Company continues to focus on overall efficiencies and enhancements including sourcing higher-grade ore material from East Pit for the remainder of 2022 and obtaining consistent higher levels of ore processing rates. For Q3 2022, the mine averaged 8,162 stacked ore tonnes per day, which is in-line with the YTD 2022 average of 8,197 stacked ore tonnes per day, a 9% betterment than YTD 2021. By improving quality control from mine drilling and blasting and oversight on scheduled crusher maintenance, the Company looks ahead to continually improve crusher throughput. With the additional high-grade ore sourced from East Pit in the second half of the year, the Company is well positioned to deliver on annual guidance of between 32,000 to 34,000 ounces of gold sold for the full year 2022.

The Company has also recently begun an exploration program in the Florence Hill and the surrounding areas and a newly announced reverse-circulation drilling program at the Moss Mine in Q4 2022.

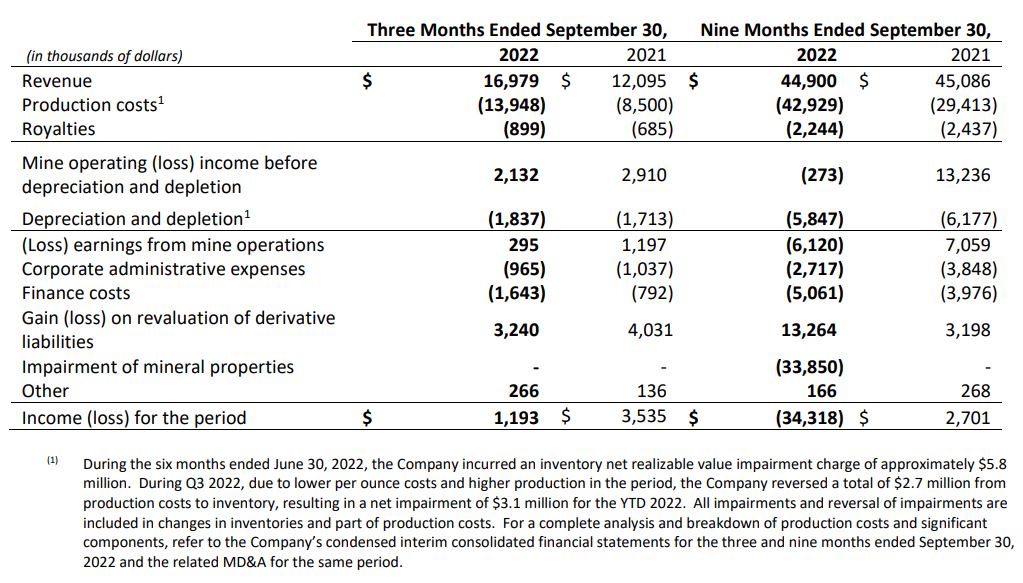

Consolidated Financial Results Summary

The following table provides a summary of the components of the Company’s net income (loss) for the three and nine months ended September 30, 2022 and 2021. For further details, refer to the Company’s condensed interim consolidated financial statements and Management Discussion and Analysis (“MD&A”) for the same periods.

Consolidated Operational Results Summary

The following table provides a summary of the Company’s operational statistics for the three and nine months ended September 30, 2022 and 2021. For further details, refer to the Company’s MD&A for the same periods.

Qualified Persons

Unless otherwise indicated, the technical disclosure contained within this press release that relates to the Company’s operating mine has been reviewed and approved by Tim J. Swendseid, Chief Operating Officer of the Company and a Qualified Person for the purpose of NI 43-101.

Additional Information

Full condensed interim consolidated financial statements for the three months and nine months ended September 30, 2022 and 2021 and related MD&A for the same period can be found at www.sedar.com and the Company's website at www.elevationgold.com.

Non-IFRS Performance Measures

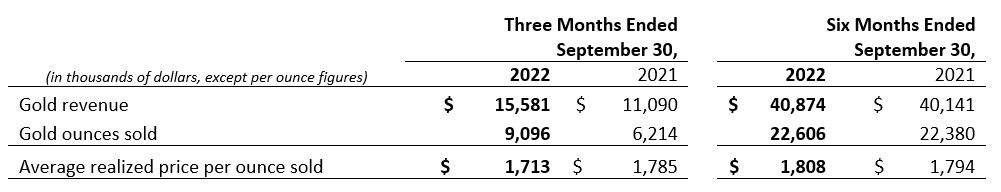

The following tables represent the calculation of certain Non-IFRS Financial Measures as referenced in this news release.

Reconciliation of Cash Costs and AISC

The Company has calculated Total Cash Costs, Total AISC, and relevant per ounce of gold unit rates consistently across each of the periods presented, which includes period adjustments for heap leach and doré impairment charges (and reversals) incurred in Q3 2022 and YTD 2022. These impairment charges and reversals (described immediately above) can create fluctuations where such adjustments occur. Management views the current quarter costs considerably lower, on a per ounce sold basis, than costs seen in the first half of 2022, when not factoring in the accounting adjustments related to impairment. For Q3 2022 and YTD 2022, without considering these adjustments in our reconciliation, Total Cash Costs would have been $13.4 million and $41.1 million, or $1,479 and $1,820 per ounce of gold sold for each respective period. Similarly, Total AISC for Q3 2022 and YTD 2022, without considering these inventory impairment adjustments, would have been $15.6 million and $53.7 million, or $1,712 and $2,377 per ounce of gold sold for each respective period.

Reconciliation of Average Realized Price of Gold per Ounce Sold

ON BEHALF OF THE BOARD OF ELEVATION GOLD MINING CORPORATION

“Tim J. Swendseid”

Tim J. Swendseid, President of Elevation Gold Mining Corporation

For Further Information, please contact:

Tim J. Swendseid, President

Elevation Gold Mining Corporation

E: tim@elvtgold.com

W: www.elevationgold.com

About Elevation Gold Mining Corporation

Elevation Gold is a publicly listed gold and silver producer, engaged in the acquisition, exploration, development and operation of mineral properties located in the United States. Elevation Gold’s common shares are listed on the TSX Venture Exchange (“TSXV”) in Canada under the ticker symbol ELVT and on the OTCQX in the United States under the ticker symbol EVGDF. The Company’s principal operation is the 100% owned Moss Mine in the Mohave County of Arizona. Elevation also holds the title to the Hercules exploration property, located in Lyon County, Nevada.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement on Forward-Looking Information

Certain of the statements made and information contained herein is “forward-looking information” within the meaning of applicable Canadian securities laws. All statements other than statements of historical facts included in this document constitute forward-looking information, including but not limited to statements regarding the Company’s plans, prospects and business strategies; the Company’s guidance on the timing and amount of future production and its expectations regarding the results of operations; expected costs; permitting requirements and timelines; timing and possible outcome of Mineral Resource and Mineral Reserve estimations, life of mine estimates, and mine plans; anticipated exploration and development activities at the Company’s projects; net present value; design parameters; economic potential; processing mineralized material; the potential of robust economic potential at the Moss Mine Project. Words such as “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “goal”, “aim”, “intend”, “continue”, “budget”, “estimate”, “may”, “will”, “can”, “could”, “should”, “schedule” and similar expressions identify forward-looking statements.

Forward-looking information is necessarily based upon various estimates and assumptions including, without limitation, the expectations and beliefs of management, including that the Company can access financing, appropriate equipment and sufficient labour; assumed and future price of gold, silver and other metals; anticipated costs; ability to achieve goals; and assumptions related to the factors set forth below. While these factors and assumptions are considered reasonable by the Company as at the date of this document in light of management’s experience and perception of current conditions and expected developments, these statements are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to: risks inherent in mining, including, but not limited to risks to the environment, industrial accidents, catastrophic equipment failures, unusual or unexpected geological formations or unstable ground conditions, and natural phenomena such as earthquakes, flooding or unusually severe weather; uninsurable risks; global financial conditions and inflation; changes in the Company’s share price, and volatility in the equity markets in general; volatility and fluctuations in metal and commodity prices; the threat associated with outbreaks of viruses and infectious diseases, including the COVID-19 virus; delays or the inability to obtain, retain or comply with permits; risks related to negative publicity with respect to the Company or the mining industry in general; health and safety risks; exploration, development or mining results not being consistent with the Company’s expectations; unavailable or inaccessible infrastructure and risks related to ageing infrastructure; actual ore mined and/or metal recoveries varying from Mineral Resource and Mineral Reserve estimates, estimates of grade, tonnage, dilution, mine plans and metallurgical and other characteristics; risks associated with the estimation of Mineral Resources and Mineral Reserves and the geology, grade and continuity of mineral deposits, including, but not limited to, models relating thereto; ore processing efficiency; information technology and cybersecurity risks; potential for the allegation of fraud and corruption involving the Company, its customers, suppliers or employees, or the allegation of improper or discriminatory employment practices; regulatory investigations, enforcement, sanctions and/or related or other litigation; estimates of future production and operations; estimates of operating cost estimates; the potential for and effects of labour disputes or other unanticipated difficulties with or shortages of labour or interruptions in production; risks related to the environmental regulation and environmental impact of the Company’s operations and products and management thereof; exchange rate fluctuations; climate change; risks relating to attracting and retaining of highly skilled employees; compliance with environmental, health and safety laws; counterparty and credit risks and customer concentration; litigation; changes in laws, regulations or policies including, but not limited to, those related to mining regimes, permitting and approvals, environmental and tailings management, and labour; internal controls; challenges or defects in title; funding requirements and availability of financing; dilution; risks relating to dividends; risks associated with acquisitions and related integration efforts, including the ability to achieve anticipated benefits, unanticipated difficulties or expenditures relating to integration and diversion of management time on integration; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs, production estimates and estimated economic return; uncertainty of meeting anticipated program milestones; and other risks and uncertainties including but not limited to those described the Company’s public disclosure documents which are available on SEDAR at www.sedar.com under the Company’s profile. All of the forward-looking statements made in this document are qualified by these cautionary statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, forecast or intended and readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. Accordingly, there can be no assurance that forward-looking information will prove to be accurate and forward-looking information is not a guarantee of future performance. Readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this document. The Company disclaims any intention or obligation to update or revise forward–looking information or to explain any material difference between such and subsequent actual events, except as required by applicable law.