May 2, 2022, Vancouver, BC – Elevation Gold Corp. (TSX.V: ELVT) (OTCQX: EVGDF) ("Elevation Gold " or the "Company") a U.S.-focused gold producer with district-scale exploration potential in the Walker Lane Trend in Arizona and Nevada, is pleased to announce financial results for the year ended December 31, 2021. All figures are expressed in US dollars unless otherwise noted.

Summary for the Year Ended December 31, 2021

- Total revenue of $58.8 million on sales of 29,175 ounces of gold and 266,088 ounces of silver. The average realized price of gold per ounce sold (1) was $1,796

- Production of 29,107 ounces of gold and 229,212 ounces of silver for 2021 from 2,757,861 ore tonnes processed with average grades of 0.43 g/t gold and 5.75 g/t silver

- Earnings from mine operations of $11.7 million before depreciation and depletion

- Commissioning and ramp up to full operation of Heap Leach Pad 3A

- Cash costs per ounce of gold sold (1) of $1,225 and all-in sustaining costs (“AISC”) per ounce of gold sold (1) of $1,997 (of which $594 per ounce was related to capital expenditures tied to exploration and heap leach pad build)

- Updated Mineral Reserve and Resource estimates and Technical Report for its Moss Mine in Q4 2021

- Completed 2021 exploration multi-phase infill and resource expansion drilling program at the Moss Mine, which included 42,570 meters of drilling and a regional exploration program conducted at the Hercules Project

(1) Refer to consolidated financial statements for the year ended December 31, 2021 for reconciliation to non-IFRS performance measures

Michael G. Allen, President of Elevation stated, “Fragmentation and crusher utilization will be the focus of operations for 2022. This will allow us to maximize throughput of the operation and lower unit costs. We are currently exposing higher grade ore in the East Pit, which when combined with higher throughput should lead to an increase in production showing up in the later half of 2022. We remain excited by the potential of the district scale property and will be testing high priority exploration targets in Q2 2022.”

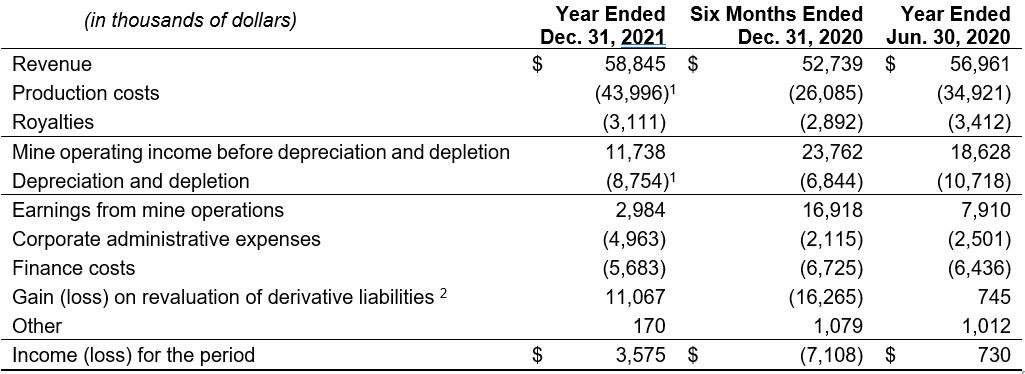

Consolidated Financial Results Summary

The following table provides a summary of the components of the Company’s net income (loss) for the year ended December 31, 2021, six months ended December 31, 2020, and year ended June 30, 2020. For further details, refer to the Company’s consolidated financial statements for the year ended December 31, 2021 and related Management Discussion and Analysis (“MD&A”) for the same period.

1) For the year ended December 31, 2021, the Company revised its estimate of recoverable silver ounces in heap leach ore inventory. Accordingly, heap leach inventory was written down by $5.7 million during the year, of which $4.9 million was included in production costs and $0.9 million was included in depletion and depreciation.

2) For the year ended December 31, 2021, includes a non-cash accounting derivative revaluation gain of $11.1 million, driven by a decrease in the Company’s share price which decreased the warrant derivative ($3.6 million) and convertible debenture derivative ($2.5 million), and a decrease in the silver stream embedded derivative ($5.0 million). For the six months ended December 31, 2020, includes a non-cash accounting derivative revaluation loss of $16.3 million, driven by an increase in the Company’s share price which increased the warrant derivative ($2.3 million) and convertible debenture derivative ($0.2 million), and an increase in the silver stream embedded derivative ($13.8 million) due largely to the increase in the silver price for the period. There were no significant fluctuations to the derivative liabilities for the year ended June 30, 2020.

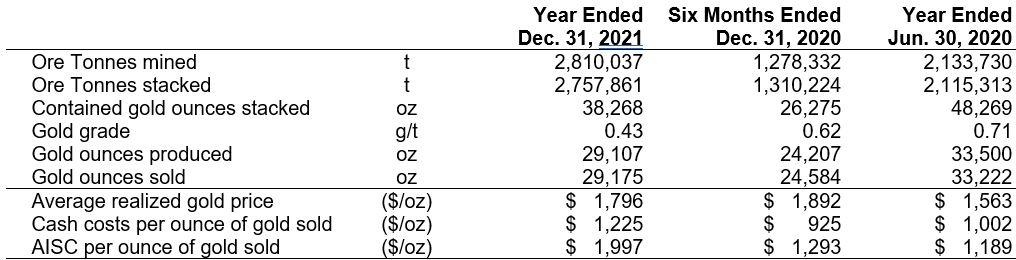

Consolidated Operational Results Summary

The following table provides a summary of the Company’s operational statistics for the year ended December 31, 2021, six months ended December 31, 2020, and year ended June 30, 2020. For further details, refer to the Company’s consolidated financial statements for the year ended December 31, 2021 and related Management Discussion and Analysis (“MD&A”) for the same period.

Qualified Persons

Unless otherwise indicated, all technical data contained in this press release that relates to geology, exploration and mineral resources has been reviewed and approved by Dr. Warwick Board, P.Geo, Vice President Exploration of Elevation Gold. He is a Qualified Person as defined by NI 43-101 responsible for the Moss Regional Exploration Project and other exploration programs and he has reviewed and approved the scientific and technical information in this press release.

Unless otherwise indicated, the technical disclosure contained within this press release that relates to the Company’s operating mine has been reviewed and approved by Tim J. Swendseid, Chief Operating Officer of the Company and a Qualified Person for the purpose of National Instrument 43-101.

Full consolidated financial statements for the year ended December 31, 2021 and related Management Discussion & Analysis for the same period can be found at www.sedar.com and the Company's website at www.elevationgold.com.

Non-IFRS Performance Measures

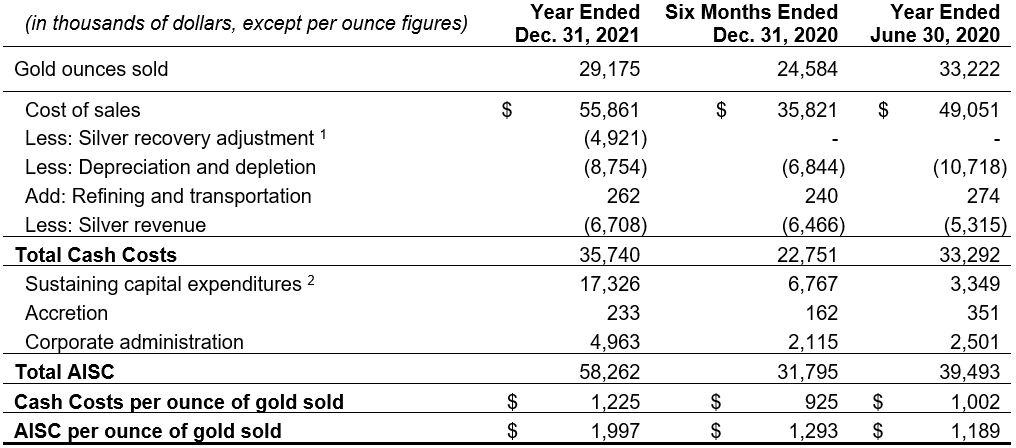

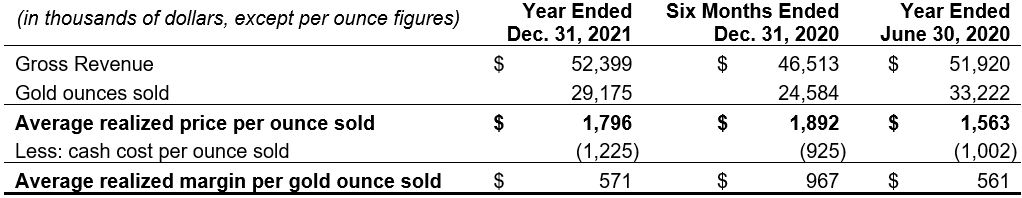

The following tables represent the calculation of certain Non-IFRS Financial Measures as referenced in this news release.

Reconciliation to Cash Costs and AISC

1) For the year ended December 31, 2021, the Company revised its estimate of recoverable silver ounces in heap leach ore inventory. Accordingly, heap leach inventory was written down by $5.7 million during the year, of which $4.9 million was included in production costs and $0.9 million was included in depletion and depreciation. As such, a reconciliation item has been included in this table.

2) AISC for the year ended December 31, 2021 are higher due to the significant investment in capital projects completed during the period, including $10.9 million on the construction of a new heap leach pad.

Reconciliation to Average Realized Price of Gold and Average Cash Margin per Gold Ounce Sold

About Elevation Gold Mining Corporation

Elevation Gold is a publicly listed gold and silver producer, engaged in the acquisition, exploration, development and operation of mineral properties located in the United States. Elevation Gold’s common shares are listed on the TSX Venture Exchange (“TSXV”) in Canada under the ticker symbol ELVT and on the OTCQX in the United States under the ticker symbol EVGDF. The Company’s principal operation is the 100% owned Moss Mine in Mohave County, Arizona. Elevation also holds the title to the Hercules exploration property, located in Lyon County, Nevada.

ON BEHALF OF THE BOARD OF ELEVATION GOLD

“Michael G. Allen”

President

CORPORATE INQUIRIES:

Michael G. Allen, President

Company Website: www.elevationgold.com

+1 (855) 633-8798 Toll Free

+1 (604) 601-3656 Office

Email: mike@elvtgold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement on Forward-Looking Information

Certain of the statements made and information contained herein is “forward-looking information” within the meaning of applicable Canadian securities laws. All statements other than statements of historical facts included in this document constitute forward-looking information, including but not limited to statements regarding the Company’s plans, prospects and business strategies; the Company’s guidance on the timing and amount of future production and its expectations regarding the results of operations; expected costs; permitting requirements and timelines; timing and possible outcome of Mineral Resource and Mineral Reserve estimations, life of mine estimates, and mine plans; anticipated exploration and development activities at the Company’s projects; net present value; design parameters; economic potential; processing mineralized material; the potential of robust economic potential at the Moss Mine Project. Words such as “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “goal”, “aim”, “intend”, “continue”, “budget”, “estimate”, “may”, “will”, “can”, “could”, “should”, “schedule” and similar expressions identify forward-looking statements.

Forward-looking information is necessarily based upon various estimates and assumptions including, without limitation, the expectations and beliefs of management, including that the Company can access financing, appropriate equipment and sufficient labour; assumed and future price of gold, silver and other metals; anticipated costs; ability to achieve goals; and assumptions related to the factors set forth below. While these factors and assumptions are considered reasonable by the Company as at the date of this document in light of management’s experience and perception of current conditions and expected developments, these statements are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to: risks inherent in mining, including, but not limited to risks to the environment, industrial accidents, catastrophic equipment failures, unusual or unexpected geological formations or unstable ground conditions, and natural phenomena such as earthquakes, flooding or unusually severe weather; uninsurable risks; global financial conditions and inflation; changes in the Company’s share price, and volatility in the equity markets in general; volatility and fluctuations in metal and commodity prices; the threat associated with outbreaks of viruses and infectious diseases, including the COVID-19 virus; delays or the inability to obtain, retain or comply with permits; risks related to negative publicity with respect to the Company or the mining industry in general; health and safety risks; exploration, development or mining results not being consistent with the Company’s expectations; unavailable or inaccessible infrastructure and risks related to ageing infrastructure; actual ore mined and/or metal recoveries varying from Mineral Resource and Mineral Reserve estimates, estimates of grade, tonnage, dilution, mine plans and metallurgical and other characteristics; risks associated with the estimation of Mineral Resources and Mineral Reserves and the geology, grade and continuity of mineral deposits, including, but not limited to, models relating thereto; ore processing efficiency; information technology and cybersecurity risks; potential for the allegation of fraud and corruption involving the Company, its customers, suppliers or employees, or the allegation of improper or discriminatory employment practices; regulatory investigations, enforcement, sanctions and/or related or other litigation; estimates of future production and operations; estimates of operating cost estimates; the potential for and effects of labour disputes or other unanticipated difficulties with or shortages of labour or interruptions in production; risks related to the environmental regulation and environmental impact of the Company’s operations and products and management thereof; exchange rate fluctuations; climate change; risks relating to attracting and retaining of highly skilled employees; compliance with environmental, health and safety laws; counterparty and credit risks and customer concentration; litigation; changes in laws, regulations or policies including, but not limited to, those related to mining regimes, permitting and approvals, environmental and tailings management, and labour; internal controls; challenges or defects in title; funding requirements and availability of financing; dilution; risks relating to dividends; risks associated with acquisitions and related integration efforts, including the ability to achieve anticipated benefits, unanticipated difficulties or expenditures relating to integration and diversion of management time on integration; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs, production estimates and estimated economic return; uncertainty of meeting anticipated program milestones; and other risks and uncertainties including but not limited to those described the Company’s public disclosure documents which are available on SEDAR at www.sedar.com under the Company’s profile. All of the forward-looking statements made in this document are qualified by these cautionary statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, forecast or intended and readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. Accordingly, there can be no assurance that forward-looking information will prove to be accurate and forward-looking information is not a guarantee of future performance. Readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this document. The Company disclaims any intention or obligation to update or revise forward–looking information or to explain any material difference between such and subsequent actual events, except as required by applicable law.